You just landed a new client. Congrats! After settling the rates and services, they asked you to fill out a form. You look at it and realize you’ve never had to fill out a form like this with your past clients. And it’s from the IRS?! Don’t sweat it! The form W-8BEN, or FW-8BEN, is actually much less intimidating than it sounds.

What is Form W-8BEN for?

Form W-8BEN is a standard tax form for people who live outside the U.S. but earn money from U.S.-based companies or clients. The purpose of this form is to confirm to the Internal Revenue Service (IRS, the agency responsible for all things tax) that you, the one who’s filling out this form, are not a U.S. taxpayer.

This form actually works in your favor. Say there’s a tax treaty between your country and the U.S. Providing a completed Form W-8BEN to your client makes sure that you qualify for reduced withholding rates or, in some cases, no withholding at all. Nice, right? So, without this form, the U.S. company you’re working for could end up withholding 30% of your payment. We obviously don’t want that! In short, this form saves you from getting paid less than what you actually earned (from a U.S.-based client) by avoiding unnecessary tax deductions.

Reminder: Not every company or client will ask you to submit a Form W-8BEN, especially for quick, one-time projects. Smaller companies or freelancers may not even be familiar with this form or may not think it’s necessary. But if you plan on working with U.S. clients more often or for the long term, then I’d recommend bringing it up with your clients to avoid any tax-related issues later on.

Who needs to fill out this form?

- A non-U.S. person who’s earning income from a U.S.-based company or client

- Freelancers, independent contractors, and business owners who aren’t based in the U.S. but provide services to U.S. clients.

Here are the details you need to prepare before filling out the form:

- Your full name

- Your date of birth

- Your permanent address

- Your mailing address (if different from your permanent address)

- Your country of citizenship

- A copy of your electronic or digital signature

- Your Taxpayer Identification Number (TIN)

How to fill it up the FORM W-8BEN (Step-by-Step Guide)

Step 1:

Download the form here.

This is an editable copy straight from the official IRS website, so you can directly fill it out on your computer (no need for PDF file editing software) or print it out should you prefer to complete it by hand.

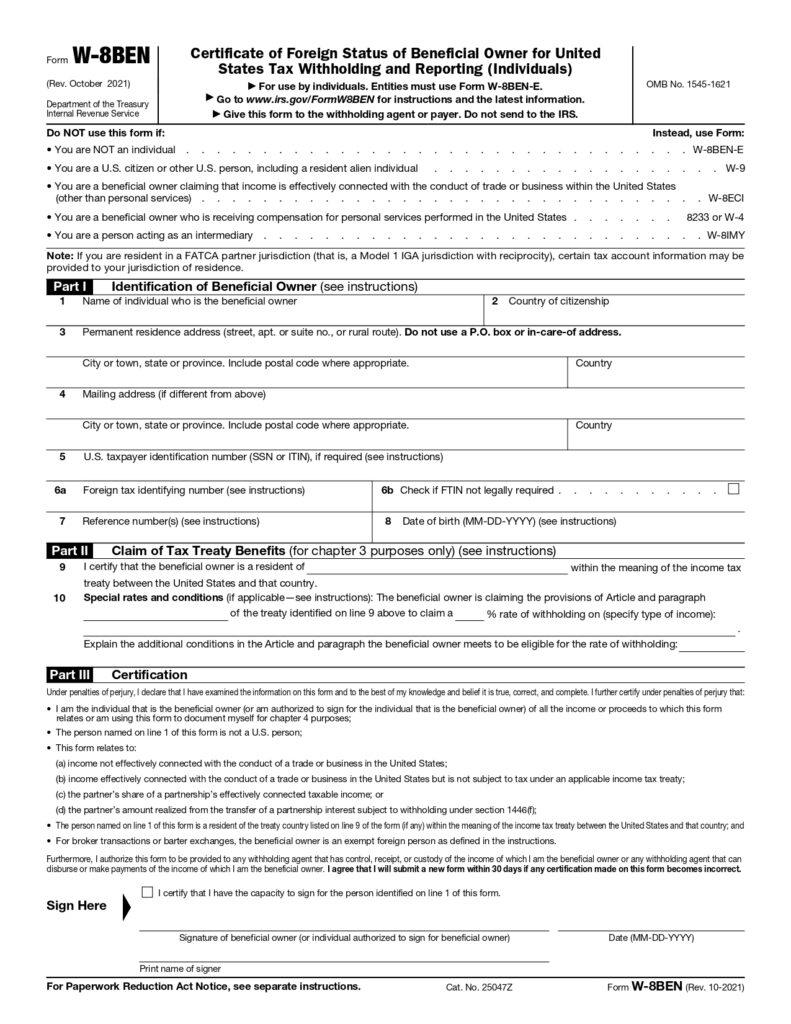

This is what the form should look like:

Step 2:

Fill out the basic details.

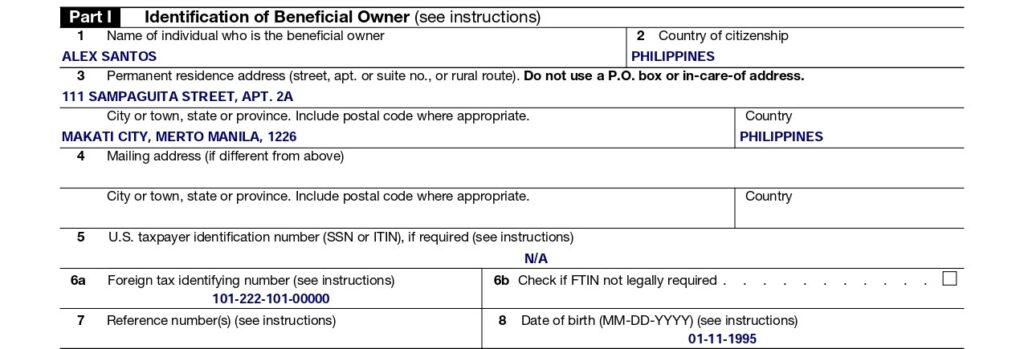

Make sure to read through the instructions first. After doing so, you can start filling out the form by writing down basic details such as:

- Line 1: Your full name

- Line 2: Country of citizenship

- Line 3: Permanent address

- Line 4: Mailing address (leave the mailing address blank if you don’t have a separate mailing address.)

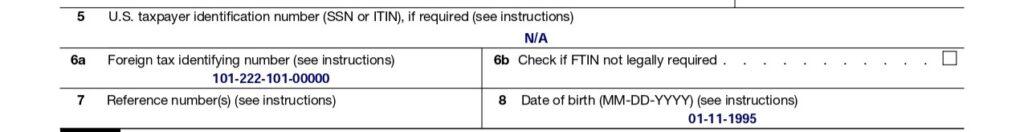

- Line 8: Your date of birth. (refer to the image below Step 3)

Step 3:

Fill out your tax details.

- Line 5 asks for a “U.S. taxpayer identification number,” but since you’re a non-U.S. individual, you likely don’t have one. Most of the time, you can leave this part blank – it’s rarely needed anyway.

- Line 6a is where you put your TIN number or your Tax Identification Number. If your country doesn’t issue FTINs or you’re not legally required to have one, you can check the box in line 6b to indicate that.

Step 4:

Enter your reference number/s (optional)

- Line 7: This is where you can add your “Reference Number(s),” which can be anything like an account number or unique ID to help your client identify you. This is optional. In fact, it’s generally recommended to leave this line blank unless your withholding agent or client specifically asks you to fill it.

After completing the details in Part 1, that section of your form should look like this:

Step 5:

Filling out Part 2 of the Form: Claim of Tax Treaty Benefits

This part of the form is where you can claim tax treaty benefits – if you qualify. If your country has a tax treaty with the U.S., you might be able to get a lower withholding rate on the income you earn from U.S. clients – think something like 10% instead of the usual 30%. That’s a huge difference!

- Line 9: Confirm your country of residence

- Line 10: If you qualify for the tax treaty benefits, specify which treaty provisions apply in your case However, most people won’t need to fill this part out unless they actually meet the requirements for a reduced rate. If you’re not sure, I recommend going

here to learn more about the tax treaties and whether or not you qualify.

Step 6:

In this final step, all you need to do is:

- Check the box to confirm that you have the capacity to sign for the person whose name is listed on line 1 of the form. (Which, of course you do because it’s you!)

- Add your full printed name

- Insert your e-signature

- Fill out the date when you signed the form

And your form is good to go! But before submitting, make sure to double-check all the information.

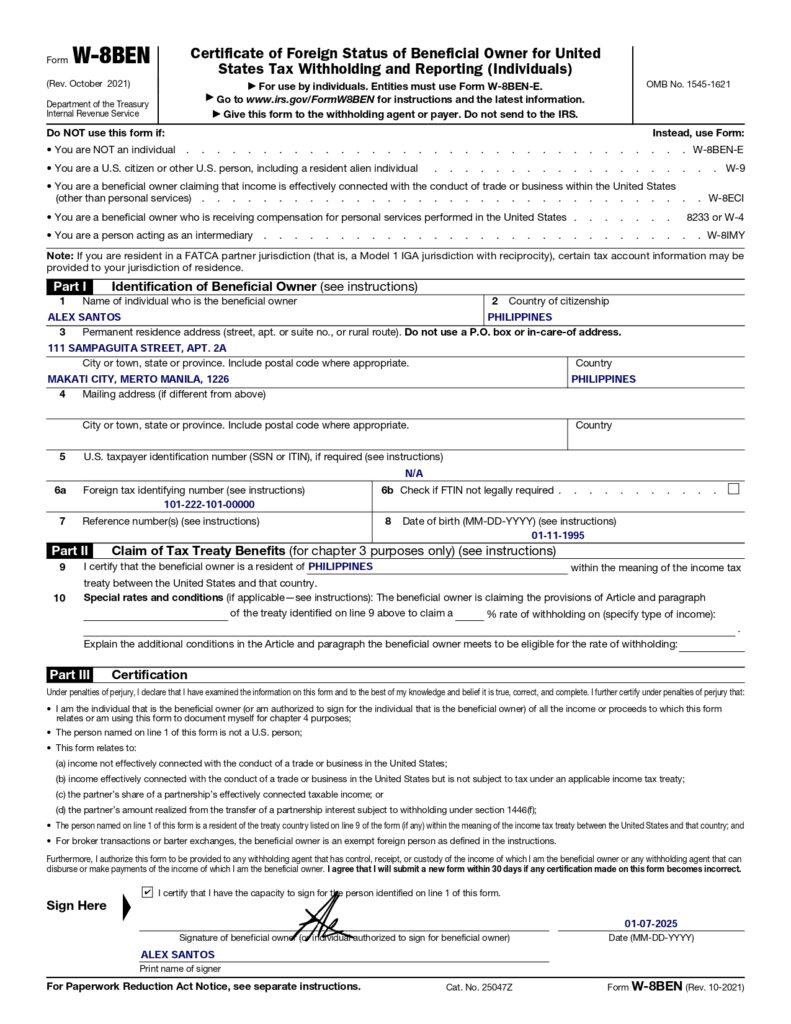

Here’s an example of a fully completed Form W-8BEN:

Once you’ve confirmed the details you’ve entered are real and accurate, congrats, you’re ready to submit your Form W8-BEN!

Submitting this form could just be the step that brings you closer to those big goals you’ve set for yourself. So, here’s to a more stable, more exciting, and more adventurous life ahead! 🍻